“Even after business resumed, we experienced a sales drop of 67%,” he wrote in an email, “because customers were not comfortable shopping in an indoor mall in close contact with other people.”

Mullet, who also serves as state senator for the 5th Legislative District, later received more than $236,000 in restaurant relief grants and at least $170,000 in loans from the Small Business Administration to help keep his three ice cream shops and one pizza parlor open. The loans were later forgiven.

“Prior to COVID we had never accessed any grant programs before,” he wrote, “but without this support I don't think the restaurant industry would have survived.”

Federal initiatives such as the Paycheck Protection Program have put hundreds of billions of dollars into floating the U.S. economy through the pandemic. That money has helped millions of Americans who own businesses or oversee family enterprises, including many public officials across Washington state who have accepted some form of assistance.

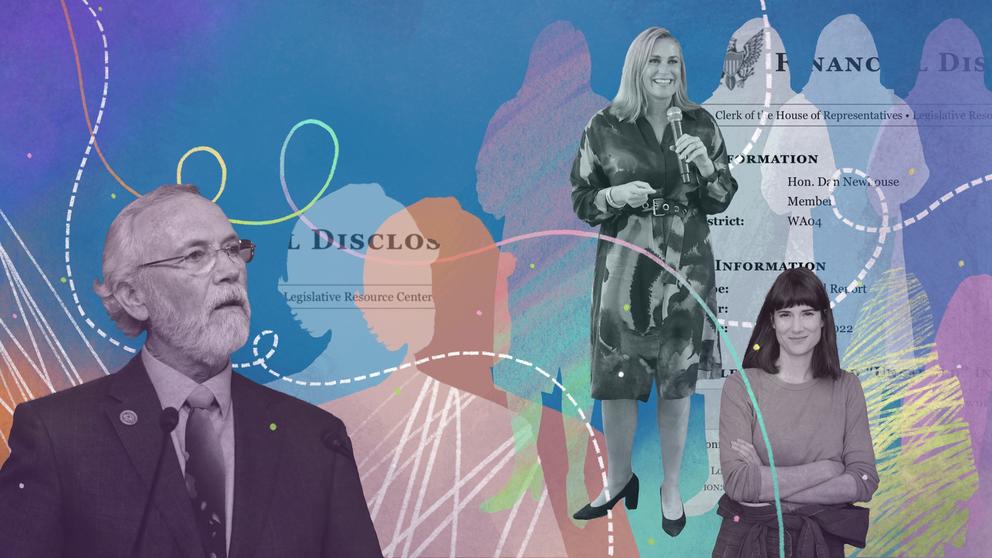

For example: Newhouse Farms, owned by Republican U.S. Rep. Dan Newhouse, received nearly $320,000 in forgiven federal loans. Dean’s Car Care, owned by Democratic Congressional candidate Marie Gluesenkamp Perez, reportedly received about $123,000 in federal loans. Wilcox Farms, partially owned by state House Minority Leader JT Wilcox, got just over $1 million in forgiven loans.

There does not appear to be anything wrong with any of these payments. In fact, all of the payments to officials and candidates Crosscut was able to find appear to qualify for the intended purposes of the relief programs. Yet, accounting for all such payments made to elected and would-be elected leaders throughout the state is difficult. These payments rarely show up in individual financial disclosures required from officials and candidates because many fall outside mandated income categories.

While oversight agencies require these individuals to file reports on their income and business interests to guard against corruption, they have largely relied on pre-existing rules to capture new forms of relief. Stimulus payments don’t always fit in, and Washington's Public Disclosure Commission specifically exempts forgiven PPP loans from reporting.

Transparency advocates Crosscut spoke to said those gaps can prevent the public from getting a consistent or comprehensive look at what kinds of payments have gone to officials and their families. Toby Nixon, with the Washington Coalition for Open Government, said that as historic levels of federal funding continue to come down through local governments, those possible conflicts of interest only increase.

“There’s absolutely a potential for corruption or self-dealing there,” he said. “With the sheer scale of it now, it certainly seems worth looking at. ... It’s a huge temptation.”

Required reporting

Elected officials and public administrators ranging from local school board members to the U.S. President must file annual financial disclosure reports by law. Members of the U.S. Senate and House file through their federal offices. State and local officials in Washington submit their reports to the Public Disclosure Commission.

Officials must detail business ownerships, investments, real estate, gifts, outstanding loans and other assets. Some categories require specific dollar amounts while others accept broad ranges. They must also disclose business ties and assets belonging to immediate family members. Candidates for office must file similar reports.

Washington state law outlines the reporting requirements and empowers the PDC to enforce disclosure. Individuals who fail to file reports can face fines or criminal prosecution.

This story is a part of Crosscut’s WA Recovery Watch, an investigative project tracking federal dollars in Washington state.

State PDC Chairman Fred Jarrett said the commission has so far treated COVID-19 relief the same as other government dollars, but that reporting criteria tend to target “compensation” or payments for goods and services. Stimulus grants or bailout loans may fall under a business’s broader financing that does not trigger individual reporting.

The PDC issued guidance in April 2021 requiring reporting of outstanding PPP loans of more than $2,400, but exempting any forgiven PPP loan payments — 95% of PPP dollars had been forgiven as of a SBA report from last month.

“We’re basically following [state law],” Jarrett said of the criteria. “[But] the rules that we have in place cover the disclosure of a lot of these things.”

Jarrett said that prior to the pandemic, the PDC asked state lawmakers to update the minimum reporting standards and add flexibility to the rules commissioners set on reporting. Those requests did not pass the Legislature in 2020 or when submitted again in 2022.

The commission has meanwhile prioritized expanding digital access to financial reports, called F-1s, and improving compliance in recent years, he said. Commissioners plan to discuss in the months ahead how they can offer better oversight.

“This may come up,” he said of COVID-19 relief.

Some officials may proactively include PPP loans or other stimulus payments to “cover their bases,” as one PDC staffer put it, but those disclosures remain inconsistent.

Congressional financial disclosure reports also omitted PPP loans or other bailout payments in many cases. The House Committee on Ethics, which oversees the disclosure standards for representatives, declined to comment on this story.

The federal Government Accountability Office and the Pandemic Response Accountability Committee both told Crosscut they had not conducted any comprehensive work to trace COVID-19 relief payments to members of Congress. They could not point to any independent resources for checking those connections.

Philip Mattera, research director for D.C.-based government watchdog Good Jobs First, said the public is left sifting through a “big universe” of financial reports and various levels of publicly available relief data to pinpoint any suspicious payments.

“Matching those up would be a challenge,” he said, adding: “We’re always looking for better transparency.”

Inconsistent information

The $790 billion Paycheck Protection Program serves as one of the largest federal efforts to provide economic stability while also detailing those payments in publicly accessible data. But it still represents a fraction of pandemic spending, offers inconsistent results and is ripe for misinterpretation.

For instance, early PPP data listed the approved totals for loans, not the actual accepted amounts, which brought scrutiny to businesses that had actually turned down the bailout loans. State Rep. Wilcox said Wilcox Farms declined most of its approved $2.8 million loan, later receiving about $1 million as forgiven relief.

Wilcox, R-Yelm, said PPP loans have proven one of the better parts of the government’s pandemic response. The aid helped his family’s farm keep staff working and producing food amid the worst of the crisis.

“That was important,” he said. “That’s exactly what it was for.”

Wilcox said he believed the program provides the necessary transparency, but he would not mind if he had to include it in financial disclosures. He noted he would prefer that relief programs continue to bear the burden of reporting recipients instead of adding new disclosures to individual reports.

The Small Business Administration has updated PPP data several times, but the lag in details can cause confusion among approved, accepted and later forgiven loan totals. Searching the public PPP data can also be imprecise. Companies with similar or matching names make it difficult to confirm which entities have connections to officials, or not.

Expanding individual reporting rules to specifically capture COVID-19 stimulus would mean each official would have any payments across multiple businesses or relief programs listed together in one place. It could also improve consistency in how payments are described, and avoid spelling or formatting variations that can make businesses hard to match to separate data.

Amid recent backlash to GOP criticism of President Biden’s student-loan forgiveness proposal, many took to social media to post Republican PPP loan totals. At least one loan to a company with a similar name was incorrectly attributed to Rep. Newhouse.

Newhouse did receive about $320,000 in forgiven loans, and his wife’s consulting company, Capitol Connections, received another $21,000 in forgiven PPP loans.

“PPP loans enabled private businesses to continue operating, providing jobs and economic output to their communities, in the face of federally-mandated restrictions,” a spokesperson wrote to Crosscut. “Newhouse Farms was eligible to apply for PPP loans in the first round of funding and applied and received funding just as any other entity would.”

For this story, Crosscut pulled recent financial disclosure reports for individuals running for federal office this year and searched for business matches to relief payments. A small sample of state and local official reports were also selected for comparison. (A disclosure report could not be found online for Newhouse’s 4th Congressional District challenger, Democrat Doug White, and Republican 7th Congressional District candidate Cliff Moon said he had not yet filed his report because his campaign launched in recent months.)

Find tools and resources in Crosscut’s Follow the Funds guide to track down federal recovery spending in your community.

Several other candidates whom Crosscut asked to comment on their reported payments did not respond, including Republican U.S. Senate candidate Tiffany Smiley. Data shows she received a forgiven loan for $2,700 to Hope Unseen in Pasco, where she lists herself as a partner.

Republican candidate for Washington’s 8th Congressional District, Matt Larkin, lists himself as a board member and legal counsel for Romac Industries in Bothell, where his children also have ownership interest. Romac Industries received nearly $6.5 million in forgiven PPP funding.

Democrat Gluesenkamp Perez, who is running for the state’s 3rd Congressional District, also did not respond to questions about federal aid for her family’s auto repair shop.

Many smaller relief programs at the state and local level do not offer any public data to match against disclosure reports. Several rounds of state Commerce stimulus grants have not published recipient data, and American Rescue Plan money passed through cities and counties does not list subrecipients of many economic development grants at the local level.

Some state-level candidates did report those grants, but often under varying names. Janelle Cass, a Republican running for state senate in the 21st Legislative District, reported receiving a $25,000 “Working WA” grant. She described the money as extremely helpful for her Edmonds business.

Cass said she understood concerns about transparency, noting the PDC could be a “one-stop shop” for payment information on potential conflicts of interest.

“I don't know how else voters would have access,” she said.

State Senate Majority Leader Andy Billig, D-Spokane, a 6.5% owner of a minor-league baseball team that received $437,000 in PPP money, told Crosscut he supports “complete transparency” on federal relief.

Reconsidering relief

Open-government advocate Nixon, who files an annual disclosure report as a Kirkland City Council member, said the level of local discretion over historic amounts of federal money creates a challenge state oversight officials have not faced before. He said the Public Disclosure Commission has proven aggressive in advancing transparency in recent years, but they should consider whether they could be doing more here.

“If the PDC really thought about it,” he said, “they would agree that the potential for conflicts of interest is huge ... [and] this increasingly seems to be the norm.”

When considering the current case-by-case process for comparing individual business interests against incomplete relief data, Nixon figures there is room for improvement. Most people can’t be expected to make those connections and the results remain unreliable.

“That's a lot of work,” he said. “It’s not centralized in one place. ... There’s just so much to go through.”

PDC Chairman Jarrett said the commission wants to examine how it collects all financial information and what insights it can do a better job of sharing with the public. He acknowledged that adding specific reporting requirements on COVID-19 relief could be part of that conversation. State legislators taking up their request for updated rule-making flexibility could also help.

Jarrett also noted he expects the commission would get some pushback on expanding reporting requirements on pandemic relief. Financial disclosure staff already face a slew of requests from officials and candidates to exempt proprietary client payments or other arguably personal details.

“That information,” he said, “is generally information that they don’t want disclosed.”